Posted 10th October 2025

Posted 4 months ago

By GS Verde Group

Cotswold Fox secure growth investment deal

Founder-led clothing brand, Cotswold Fox, has secured a growth investment on a deal advised by GS Verde Group.

Growth capital is a type of private equity investment, usually a minority investment. Businesses seeking growth capital often do so to finance a transformational event in their lifecycle, such as expanding or restructuring operations, entering new markets or financing a significant acquisition without a change of control of the business.

Many growth funding investors are specialists in the sectors they invest in, bringing knowledge, expertise and contacts alongside their financial backing.

Interested in how growth funding could expand your business?

Growth funding is designed to aid businesses get to the next level and achieve greater profitability and can accelerate a business’ growth.

It is most suited to more mature businesses, already established in their market with proven success.

The requirements for obtaining and using growth funding will vary by business and sector, but often a business will need to provide evidence or demonstrate that it meets certain criteria.

There are a number of benefits to growth funding, including:

Find out how the GS Verde Group can support your business

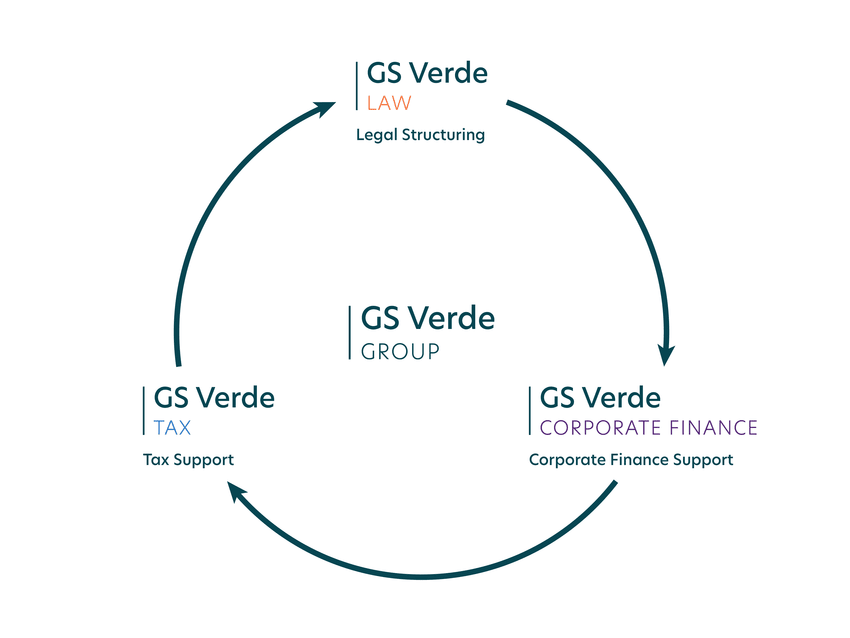

All the support you need, under one roof

A business owner will require both legal and financial support throughout the process of raising growth funding. At the GS Verde Group, we can help with both.

Preparing the business for funding, matching with investors, and negotiating the deal are all necessary steps. As a Group, we are able to support business owners through the entire EOT process and we were delighted to recently do just this for Paramount Interiors.

To find out if you and your business are ready for growth funding, contact us

Founder-led clothing brand, Cotswold Fox, has secured a growth investment on a deal advised by GS Verde Group.

Dock Solutions, the UK’s largest manufacturer of loading bay equipment, has completed a strategic refinance deal, in a deal advised by GS Verde Group.

Guilford Street Laboratories has successfully completed a follow on investment round, in a deal advised on by GS Verde Group.

The GS Verde Group recently worked with Paramount Interiors, providing transaction support for their EOT undertaking.

From the owner:

“Paramount Interiors have many long-standing staff members, and the people here are at the heart of all that we do. I am absolutely delighted with the opportunity to reward our talented team with a stake in the business for the outstanding contribution and commitment they have shown over the many years.”

Richard Jones, Managing Director

From the employee:

"Richard’s decision to sell his majority shareholding reflects not only how much he values our staff but also the respect they have for him in terms of how committed they all are.”

Helen Bartlett, EOT Board Member