Advantages

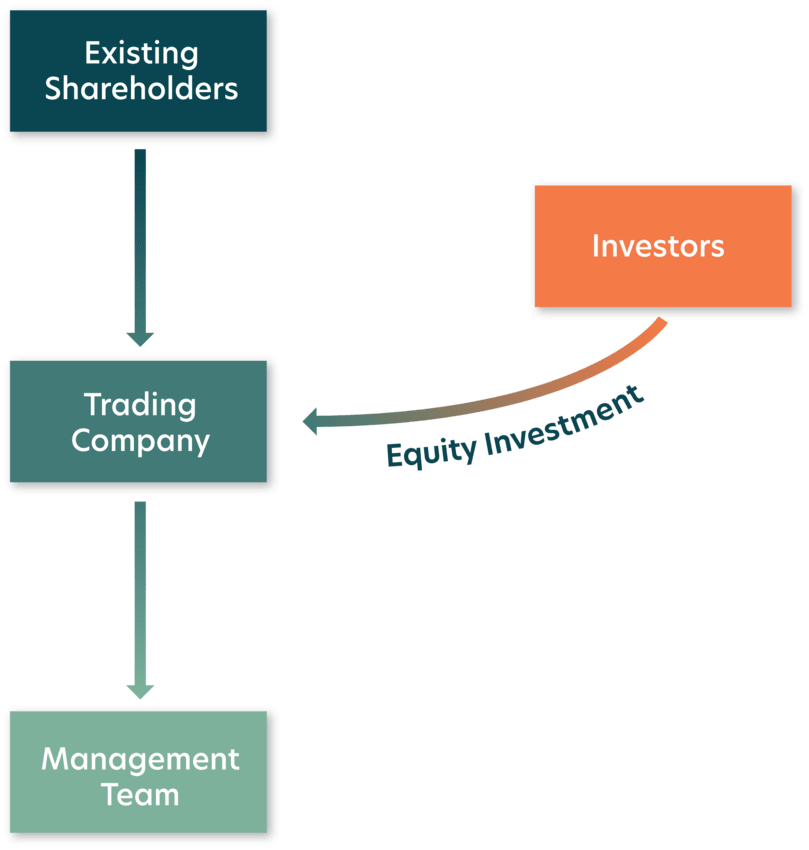

Relative simplicity and non-disruption: The daily operations, employees, customers, and other stakeholders can remain unchanged – only the ownership structure undergoes significant alteration.

Owner remains in role: Similar to the non-disruptive aspect of a private equity deal the founder or owner can remain in their role and maintain strategic or operational control. A successful PE sale constitutes the backing of the management team’s vision and plan for the business.

Grow board expertise: The sale of equity can bring on new stakeholders, who can provide knowledge, experience, and opportunities. This can unlock new potential for a business, such as specialist sector expertise or access to new networks and channels to further develop your contacts.

Access to capital: In exchange for a portion of shares comes an often significant amount of capital, which can be used for a variety of purposes; investing in equipment, geographic expansion or other forms of growth and development.