Looking for an example of an MBO?

Case Study

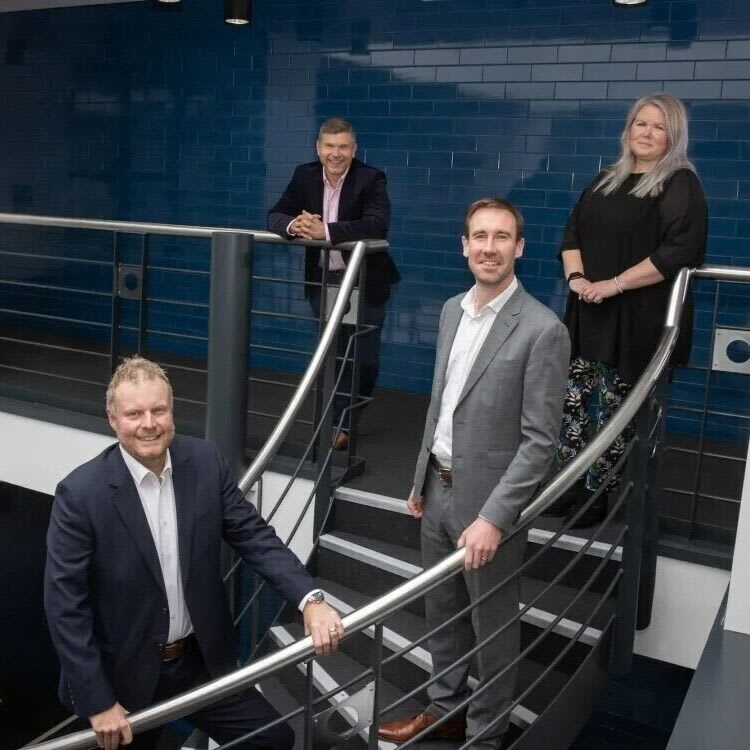

Led by Richard Jones, MD, the management team at Paramount Interiors completed a buyout in 2018 supported by the GS Verde Group.

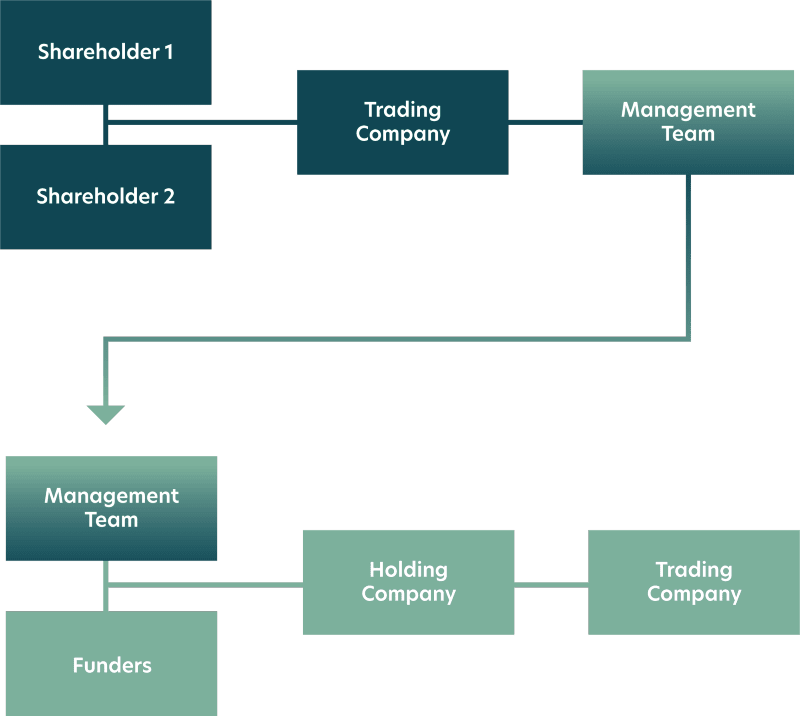

GS Verde supported at every stage of the process, from the business valuation to financial modelling, legal structuring, tax structure, and shareholder agreements.

“I am very excited about what the future will hold for Paramount, myself and the management team as a result of the MBO. We have an exceptional team [...] and the MBO allows us to invest further in our people, our facilities and the service that we provide to our clients to ensure that we continue to be one of the best in our field.” – Richard Jones, MD, Paramount Interiors.