How does Due Diligence create value in a business sale?

Case study

Rawlings & Son Ltd acquired Paper Bag Co, both leading packaging specialists in the Southwest.

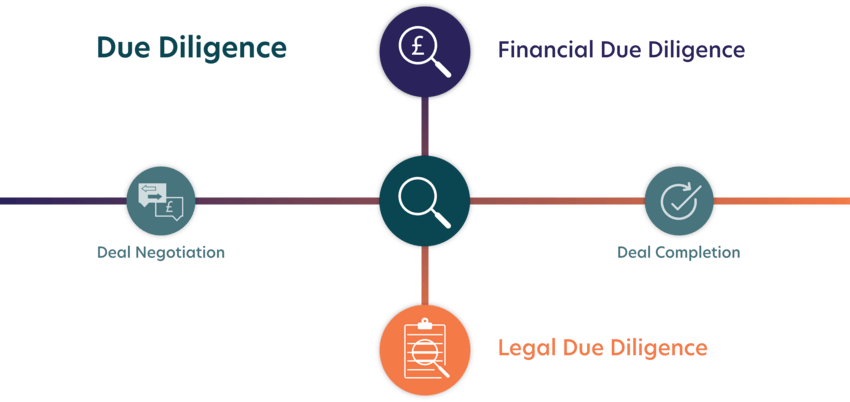

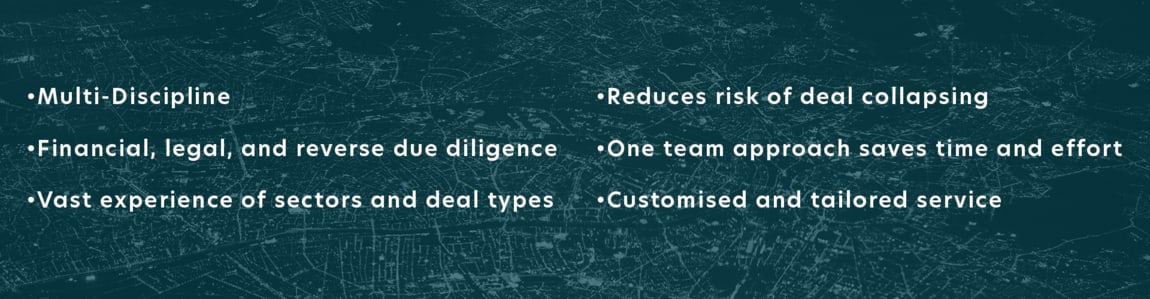

GS Verde’s multidiscipline dealmakers worked as a single team to support Rawlings & Son throughout the transaction. End-to-end support included legal and financial services, deal structuring, financial and legal due diligence, negotiating deal terms, and drafting new contracts and agreements.

“The acquisition provides Rawlings with the opportunity to develop our product offering, increase our service capacity, and expand our client base - realising our growth ambitions. Having the support of GS Verde’s expert multidiscipline team for everything we needed allowed us to move forward with the transaction with confidence.”

– Tom Wood, CEO, Rawlings & Son Ltd.

Looking for further info about acquisition?

Read more about buying a business