Posted 10th October 2025

Posted 5 months ago

By GS Verde Group

Cotswold Fox secure growth investment deal

Founder-led clothing brand, Cotswold Fox, has secured a growth investment on a deal advised by GS Verde Group.

Debt funding is a method for a business to raise capital through means of borrowing. This funding is often secured against a tangible asset and will be repaid at a later date, typically through regular payments with additional interest.

To secure debt funding, therefore, your business should have a financial track record and be able to demonstrate that you can repay the borrowed funds. Debt funding is suitable for businesses that would prefer to retain ownership and decision rights.

Interested in how debt funding could help grow your business?

Debt financing allows you to maintain complete control of your business as the sole decision-maker. This type of funding can be easier to acquire compared to other routes, and once your debt is paid your liability is over.

Debt funding means that the business is in debt for a period of time, and therefore must have sufficient cash flow to pay the principal and interest obligations tied to the loan.

As a result, collateral against the value of the borrowed sum is often required.

There are a number of benefits to debt funding, including:

Find out how the GS Verde Group can support your business

All the support you need, under one roof

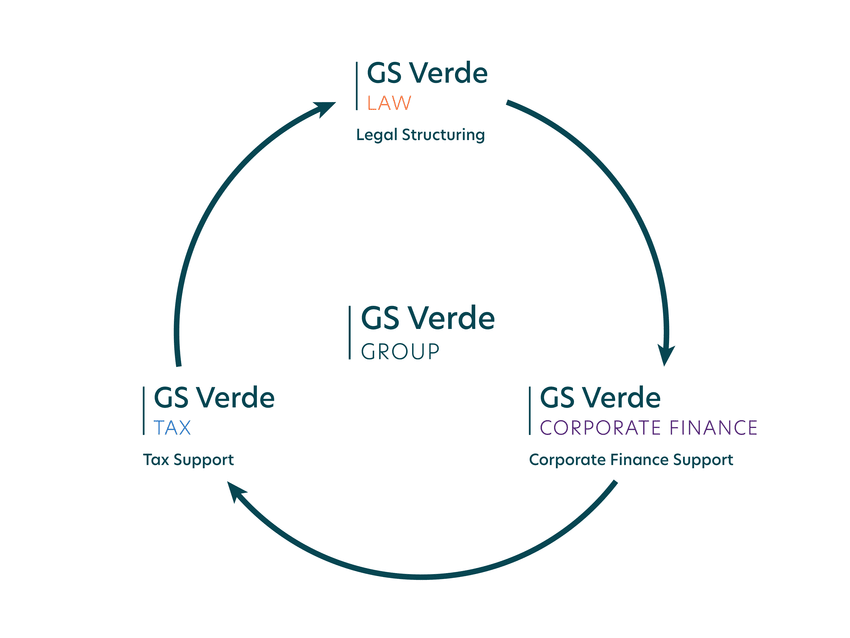

A business owner will require both financial and legal support during a fundraising. At the GS Verde Group, we can help with both.

Preparing for investment, negotiating for the best terms and legal structuring are all necessary steps. As a Group, we are able to support business owners through the entire debt financing process.

To find out if debt funding is the right route for you and your business, contact us.

Founder-led clothing brand, Cotswold Fox, has secured a growth investment on a deal advised by GS Verde Group.

Dock Solutions, the UK’s largest manufacturer of loading bay equipment, has completed a strategic refinance deal, in a deal advised by GS Verde Group.

Guilford Street Laboratories has successfully completed a follow on investment round, in a deal advised on by GS Verde Group.

The GS Verde Group recently worked with Paramount Interiors, providing transaction support for their EOT undertaking.

From the owner:

“Paramount Interiors have many long-standing staff members, and the people here are at the heart of all that we do. I am absolutely delighted with the opportunity to reward our talented team with a stake in the business for the outstanding contribution and commitment they have shown over the many years.”

Richard Jones, Managing Director

From the employee:

"Richard’s decision to sell his majority shareholding reflects not only how much he values our staff but also the respect they have for him in terms of how committed they all are.”

Helen Bartlett, EOT Board Member