Inside AI: Funding Landscape & M&A Impact

posted 25th May 2023

It's hard to escape some iteration of Artificial Intelligence in everyday life, whether it's on social media, navigation, auto-correct, or in video games, AI has permeated our lives in ways we often don't even notice. It's rare that thoughts on a specific sector are so divided, so GS Verde has taken a look at the current environment for AI businesses in the UK to see if we can find any insights there.

The UK government has shown significant interest in developing and supporting AI technologies since 2018. The Chancellor’s Spring Budget in 2023 placed science and technology at the heart of the UK’s plan for economic growth with a particular focus on Artificial Intelligence (AI). The government will invest in the region of £900 million to build an exascale supercomputer and to establish a new AI Research Resource, with initial investments starting this year.

The current landscape of AI funding in the UK

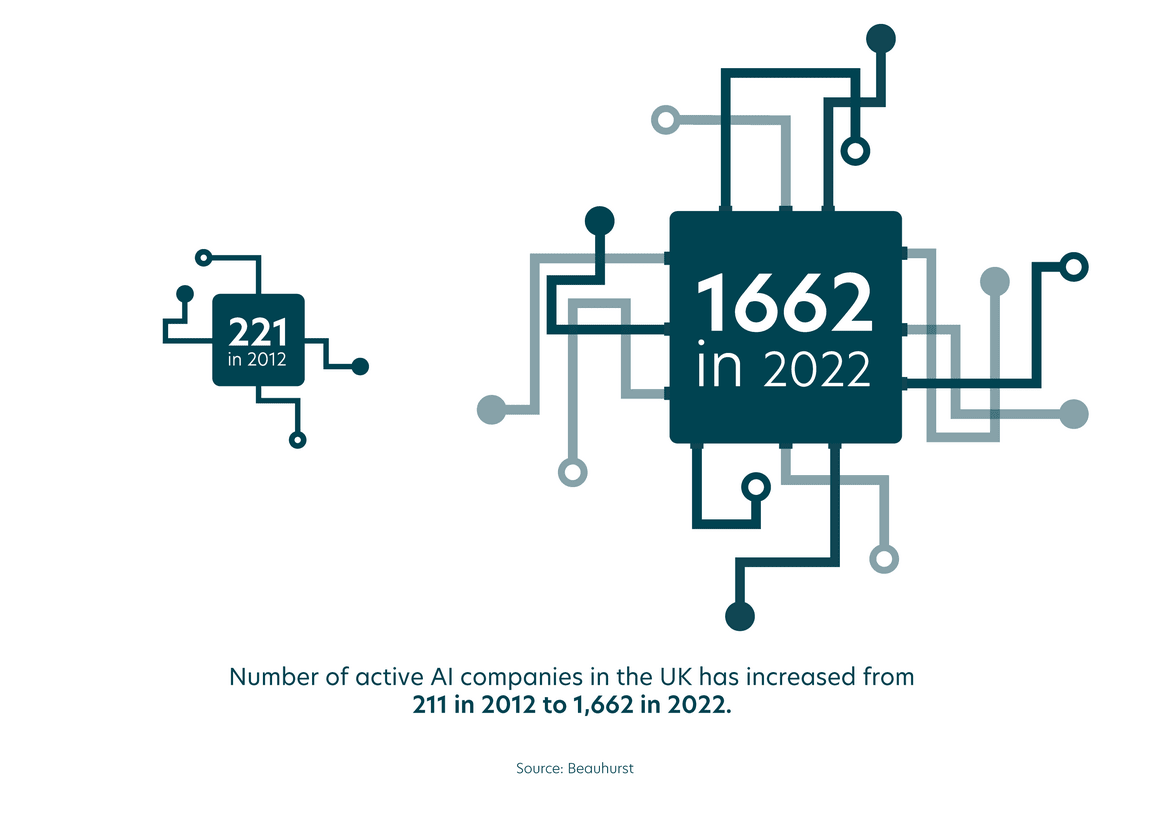

The number of active AI companies in the UK has increased from 211 in 2012 to 1,662 in 2022 – that’s an impressive 688% of growth.

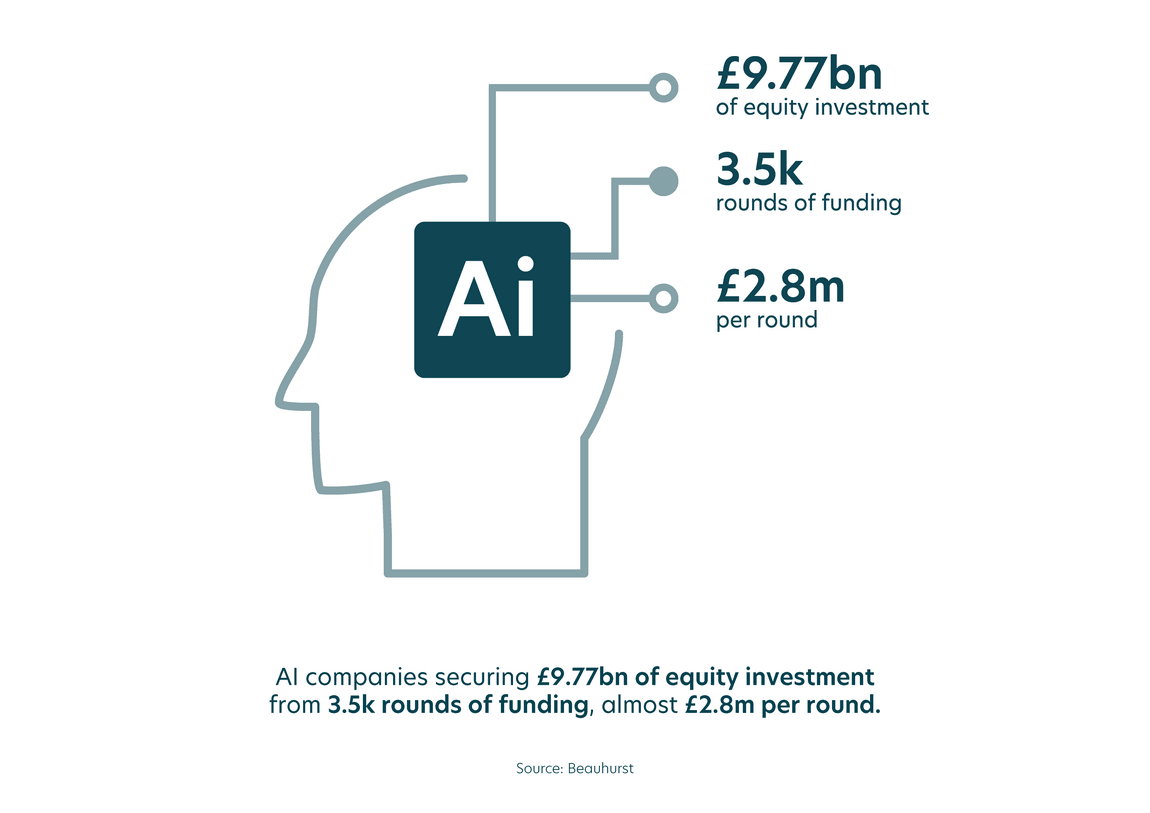

Over this time, the landscape of AI business in the UK, and the world, has changed significantly. It’s certainly a high-growth area, with UK-based AI companies securing £9.77bn of equity investment from 3.5k rounds of funding within the same time period – almost £2.8m per round – making it the second-best funded sector in the UK.

Artificial intelligence has the potential to take all sectors by storm and revolutionise many areas of business, but the largest players in AI focus on cybersecurity, health, financial services, and AI components themselves, with those securing the most venture capital investment including the likes of OneTrust, Graphcore, Thought Machine, BenevolentAI, and Quantexa, as reported by Beauhurst.

How will AI impact the M&A Sector?

AI significantly impacts the Merger & Acquisition (M&A) industry, transforming various aspects of the process and enhancing decision-making. Here are some ways in which AI can influence the M&A industry:

Identifying potential targets: AI can analyze vast amounts of data and identify potential target companies that align with specific criteria. It can automatically screen and evaluate large databases, including financial statements, industry reports, news articles, and social media data, to provide insights into suitable targets for acquisition.

Due diligence and risk assessment: AI-powered algorithms can streamline due diligence processes by automating the analysis of legal, financial, and operational documents. This technology can detect anomalies, assess risks, and identify potential synergies or challenges, thereby enabling more efficient and thorough evaluations.

Valuation and pricing: AI algorithms can analyze historical financial data, market trends, and comparable transactions to assist in the valuation and pricing of companies. This technology helps in identifying patterns and correlations that humans might overlook, resulting in more accurate valuations.

Predictive analytics: AI algorithms can leverage historical data to make predictions about future performance and assess the potential impact of a merger or acquisition. By using machine learning models, M&A professionals can gain insights into the likely synergies, risks, and financial outcomes associated with a deal.

Deal sourcing and matchmaking: AI-powered platforms and marketplaces facilitate deal sourcing by connecting buyers and sellers based on their specific requirements. These platforms leverage algorithms to match potential partners, increasing the efficiency and reach of the M&A process.

Post-merger integration: AI can help streamline post-merger integration processes by automating tasks such as data consolidation, systems integration, and workflow optimization. Machine learning algorithms can also provide insights into cross-selling opportunities, customer behaviour analysis, and operational improvements.

Enhanced decision-making: AI provides M&A professionals with data-driven insights and predictive analytics, enabling more informed decision-making throughout the entire M&A process. This technology helps identify potential risks, quantify synergies, and evaluate the strategic fit of a transaction.

Overall, AI has the potential to accelerate the M&A process, improve decision-making, and uncover opportunities that might otherwise be missed. However, it is important to note that human expertise and judgment remain crucial in interpreting AI-generated insights and making strategic decisions in the M&A industry.

But what does the future hold?

With the world buzzing about Chat GPT and the potential risk of AI replacing various tasks and jobs, it can often seem that the growth of AI might be outpacing society's capacity to understand the capabilities and limitations that currently exist, causing more and more people to call for greater regulations when it comes to AI.

With experts calling for a pause in the training of powerful AI systems , is the sector at risk?

What do you think about artificial intelligence? Should we be taking advantage of the potential and pushing for advancement?

or should we exercise more caution in our pursuit of the next AI of the moment?